Which Cd Pays Earnings Based on the Stock Market

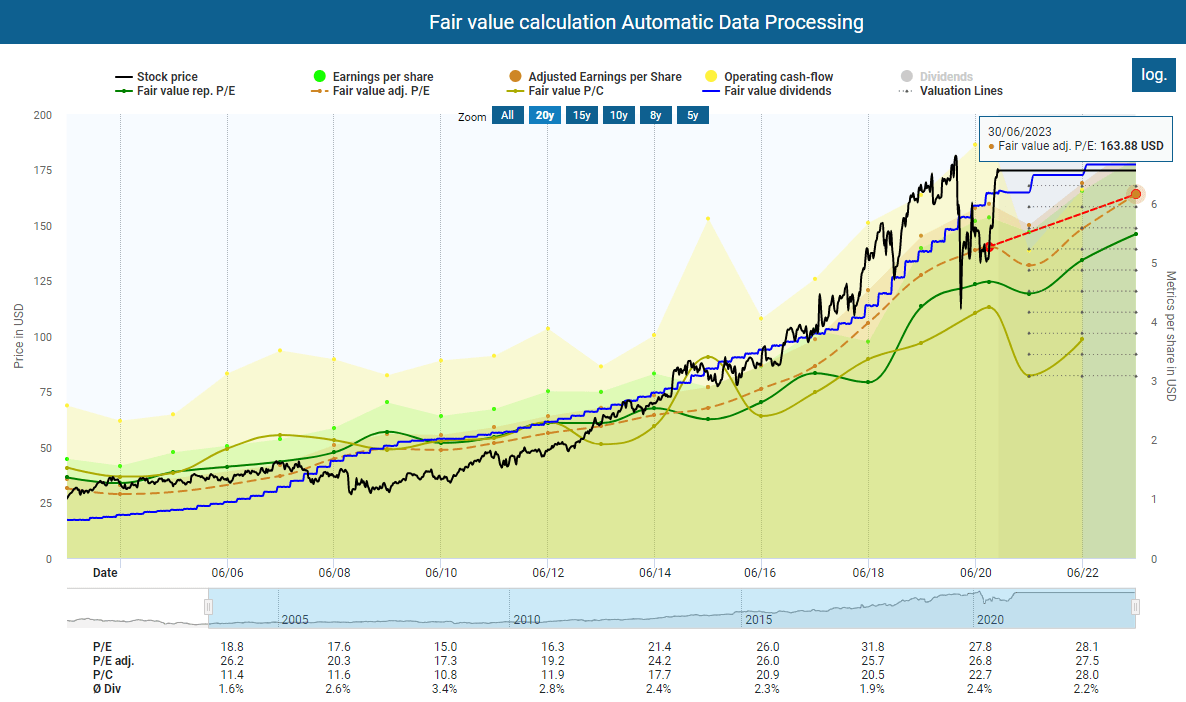

This calculation can be reversed to help you divine a fair price to pay for a stock based on its intrinsic value. Marcus bought a certificate of deposit whose interest rate is based on the stock market.

S P 500 Index Fund Average Annual Return The Motley Fool

A CD will pay you some interest but youll also have to pay the government.

. In response the FDIC was established to regulate banks and give investors such as CD holders assurance that the government would protect their assets up. Add-On Certificate of Deposit. Certificates of deposit CDs are popular safe-haven investments for people looking for a steady return that isnt tied to stock market performance.

You can find rates two to three times higher than the national averages of 015 for one-year terms and 029. In the past CDs were a stable part of my overall. Wall Street had been looking for EPS of 124 on revenue of 579 million so the company beat the top-line.

13 hours agoEarnings per share rose 25 to 114 and adjusted FFO per share jumped 42 to 185. Just like money you would stick in a savings or money market account money thats saved in a. CDR is less volatile than 75 of Polish stocks over the past 3 months typically moving - 6 a week.

If you need to withdraw money from your CD before it matures you may have to forfeit some of your earnings or pay a stiff early withdrawal penalty. To counteract the economic slowdown the Fed slashed the Fed Funds rate to 0 - 025 in 2020. A major turning point for CDs happened in the early twentieth century after the stock market crash of 1929 which was partly due to unregulated banks that didnt have reserve requirements.

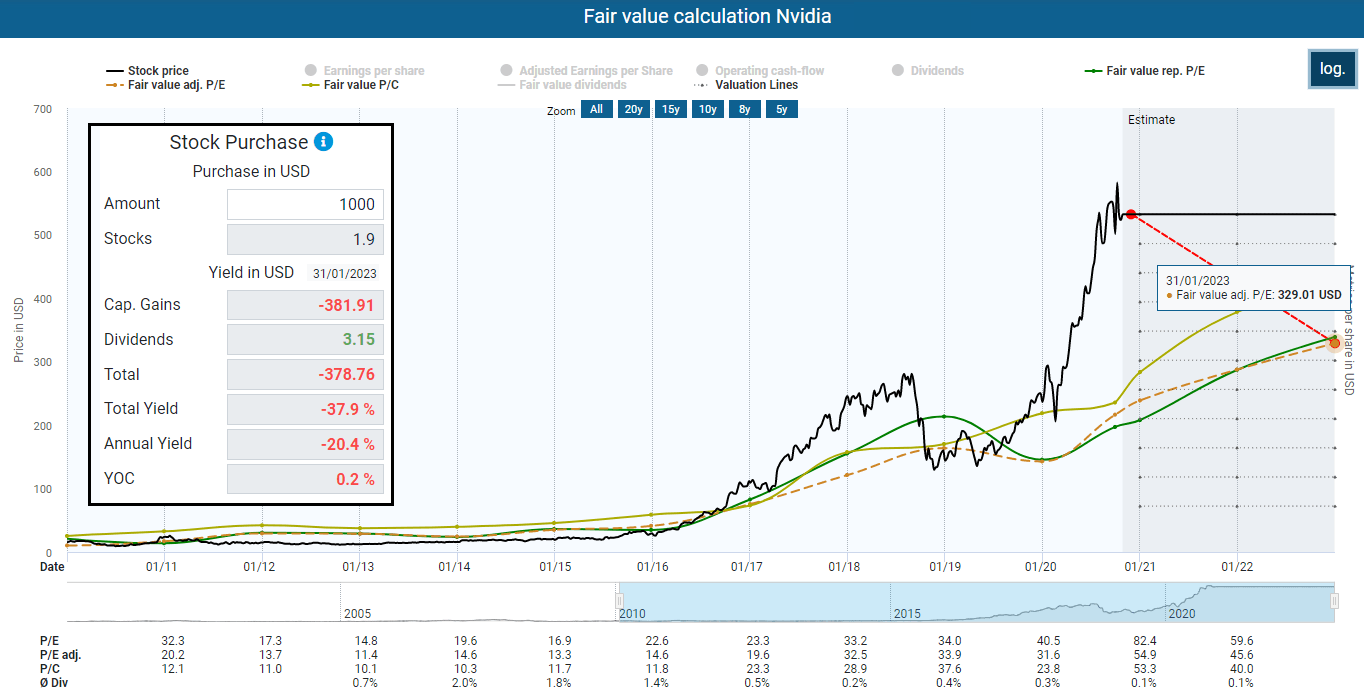

The current price of the stock is 1000 per share. Whenever you have questions about how to report something on your taxes correctly speak with a tax preparer or CPA who can provide specific guidance based on your situation. Sometimes his earnings are higher than other.

05-03 Compare the Costs and Benefits of Various Savings Plans Topic. But by the end of 2016 1-year returns for stocks sat at 1213 while the CDs earned just 030. In effect the 50.

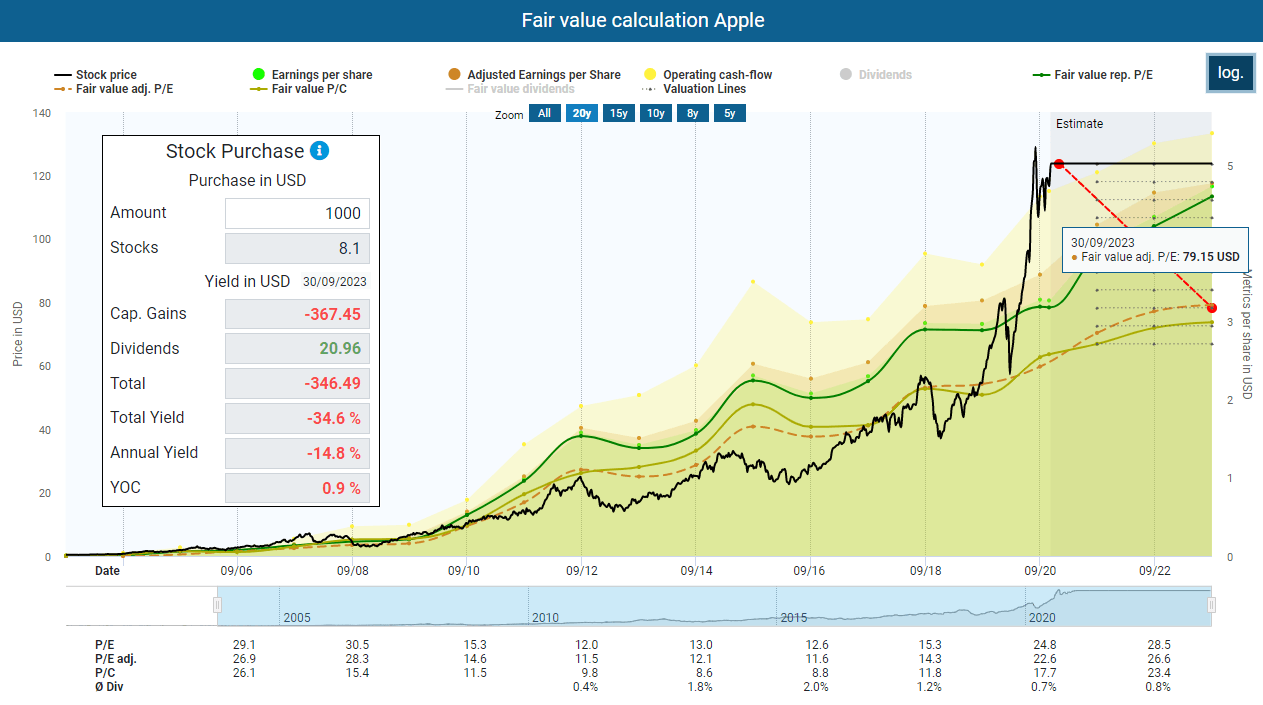

At this rate the price-to-earnings ratio is 10 suggesting that investors pay 10 times earnings to own shares in the company. Certificates of deposits aka CDs are now paying extremely low rates due to the pandemic and the Federal Reserve. In Reeses example an investor might put 10000 into a market-linked CD guaranteeing 15 percent or 150 a year while an ordinary CD would pay 2 percent or 200 a year.

4 hours agoAll told Verizons adjusted earnings declined by less than 1 to 135. A certificate of deposit that allows the bearer to deposit additional funds after the initial purchase date that will bear the same rate of interest. As a result its a good idea to look for CD investment alternatives to potentially earn higher returns.

Online banks and credit unions tend to have the best yields on certificates of deposit. The bad news is that bank-issued CDs typically yield low returns while CDs offering dramatically higher interest rates may not be FDIC insured. And its adjusted earnings before interest taxes depreciation and amortization -- a.

CDRs weekly volatility 6 has been stable over the past year. Taking a look at decades as a whole the annualized returns for stock outperformed CDs for the 1980s 1990s and 2010s up to 2017. In the 1970s and 2000s CDs faired better.

2 days agoPinterest PINS 408 is slated to report its first-quarter 2022 results after the market closes on Wednesday April 27. 12 hours agoStocks arent like children -- its OK to talk publicly about which investments are your favorites. Find the latest Chindata Group Holdings Limited CD stock quote history news and other vital information to help you with your stock trading and investing.

Its no surprise that CDs came out the winner in the 2000s given the. 151 Which CD pays earnings based on the stock market. He purchased a Multiple Choice Bump-up CD.

A measure of the value of a company calculated by multiplying the number of outstanding shares by the current price per share. Moodys Daily Credit Risk Score is a 1-10 score of a companys credit risk based on an analysis of the firms balance sheet and inputs from the stock market. Sometimes his earnings are higher than other similar cds and at other times his earnings are lower.

For short-term CDs or those that pay interest frequently you get a 1099-INT each year for the earnings you received. 10 least volatile stocks in PL Market. But taxes due on the yield from a CD can take a.

A conference call with analysts is scheduled for the same day at 430 pm. CDs are often used to fund goals within a 10-year time frame when you may not want to risk the price fluctuation of market-based options such as a stock mutual fund. I own shares of more than 60 different companies but Disney DIS -200 Costco COST -144.

For example a company with 100 million shares of stock outstanding and a current market value of 25 a share has a market capitalization of 25 billion.

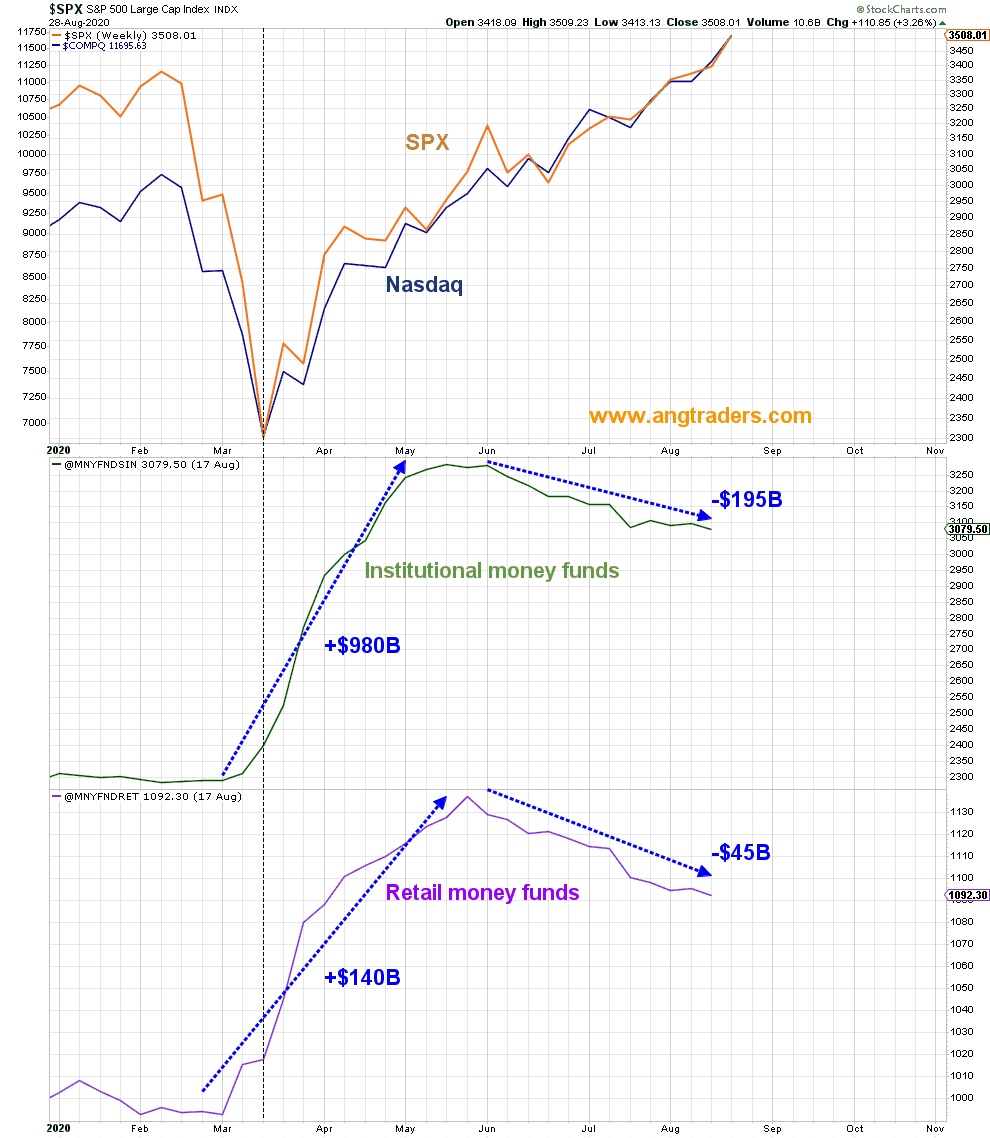

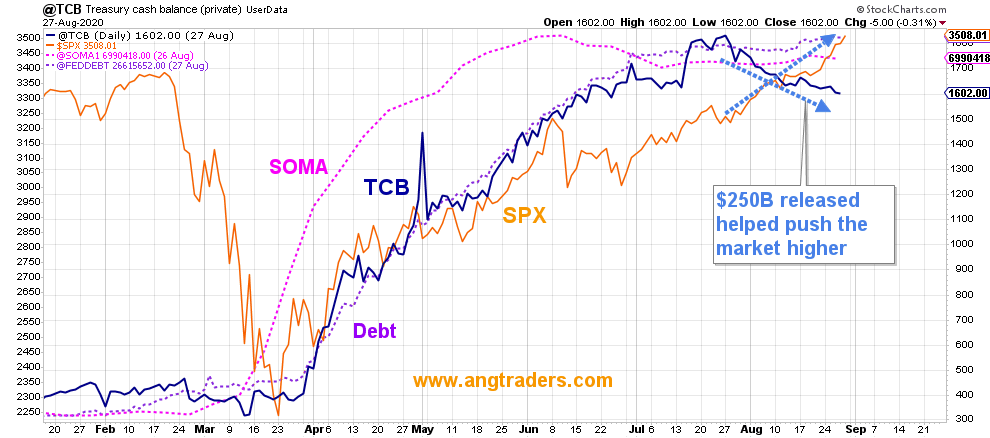

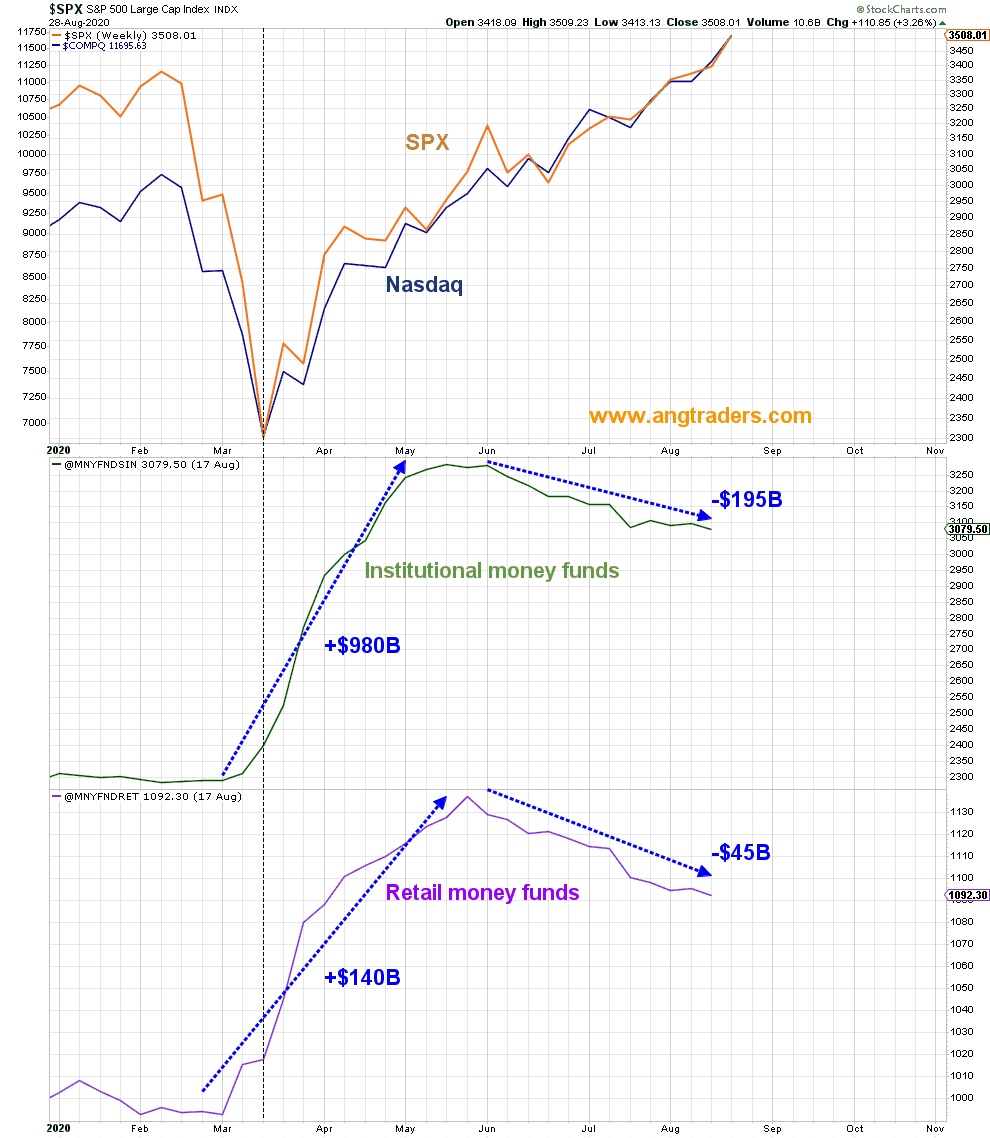

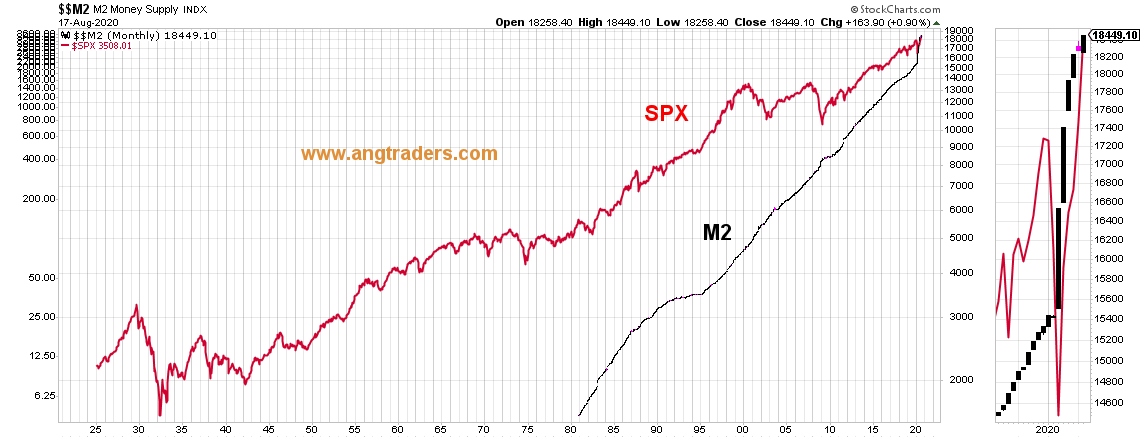

This Is Where The Money Fueling The Stock Market Is Coming From Seeking Alpha

How Do Interest Rates Affect The Stock Market

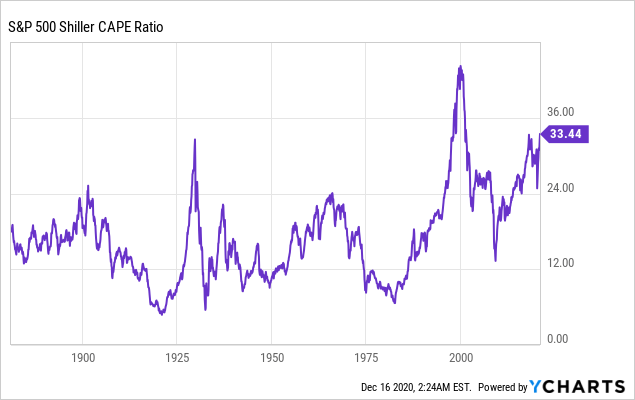

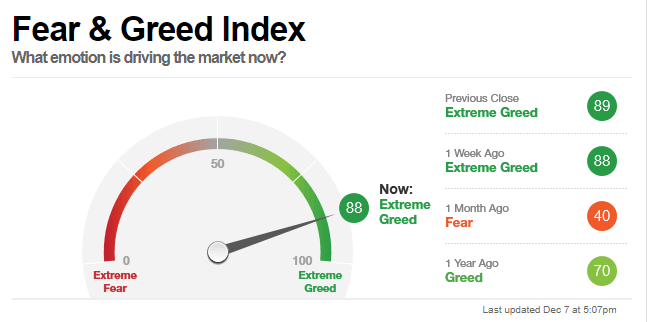

The Next Stock Market Crash Is Rooted In This Cognitive Misconception Seeking Alpha

Historic Volatility Tells Me This Stock Market Is In The Middle Of An Equally Historic Crash Wolf Street

The Safest Stocks To Buy If There S A Stock Market Crash The Motley Fool

The Next Stock Market Crash Is Rooted In This Cognitive Misconception Seeking Alpha

How Do Interest Rates Affect The Stock Market

The Next Stock Market Crash Is Rooted In This Cognitive Misconception Seeking Alpha

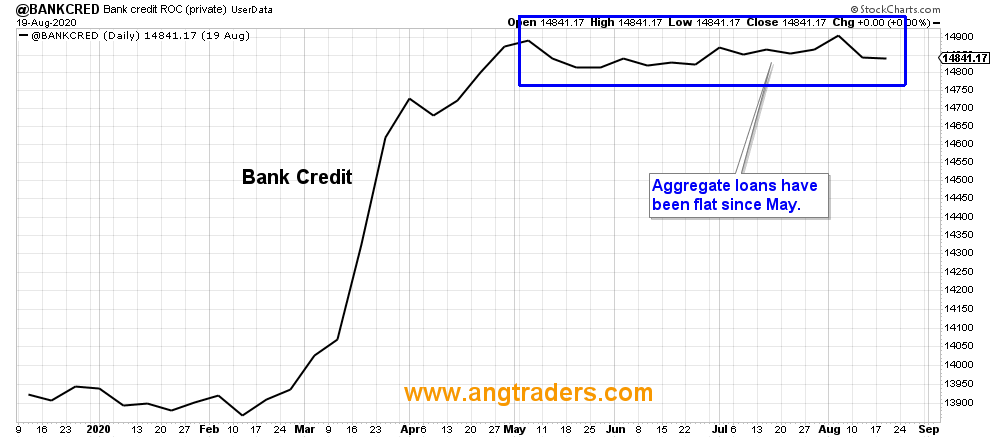

This Is Where The Money Fueling The Stock Market Is Coming From Seeking Alpha

The Next Stock Market Crash Is Rooted In This Cognitive Misconception Seeking Alpha

Should I Buy Cds During A Stock Market Correction

The Next Stock Market Crash Is Rooted In This Cognitive Misconception Seeking Alpha

Historic Volatility Tells Me This Stock Market Is In The Middle Of An Equally Historic Crash Wolf Street

The Next Stock Market Crash Is Rooted In This Cognitive Misconception Seeking Alpha

How I Became A Millionaire At 43 The Motley Fool

How Do Interest Rates Affect The Stock Market

This Is Where The Money Fueling The Stock Market Is Coming From Seeking Alpha

A Stock Market Crash May Be Close 4 Must Know Metrics That Ll Make You A Smarter Investor The Motley Fool

This Is Where The Money Fueling The Stock Market Is Coming From Seeking Alpha

Comments

Post a Comment